Stable Cost

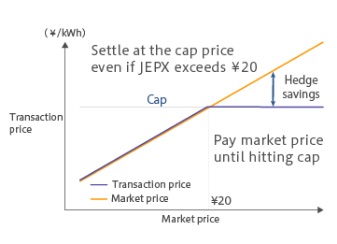

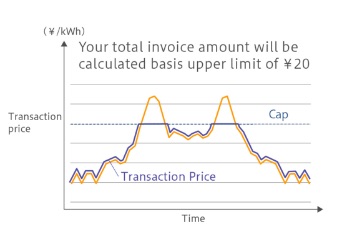

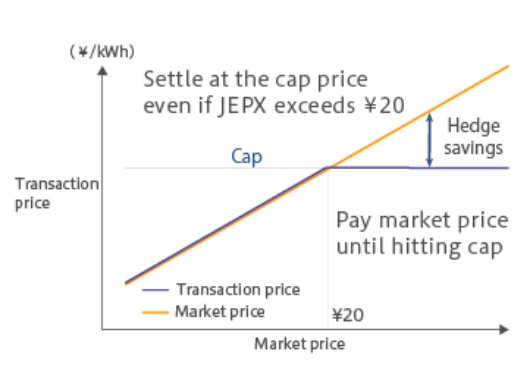

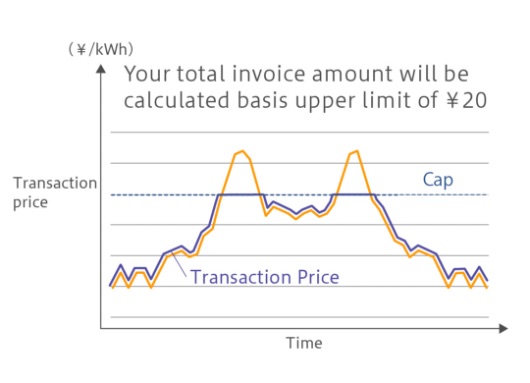

You can hedge power price risk with our tailor-made solution.

We "enetrade" support power retailers by providing stable power supply, risk management and tailor-made solutions for the sake of sustainable development of power industry.

Our core business principal is to create "Power Trading Innovation" and we are committed to meet all kinds of needs for power retailers.

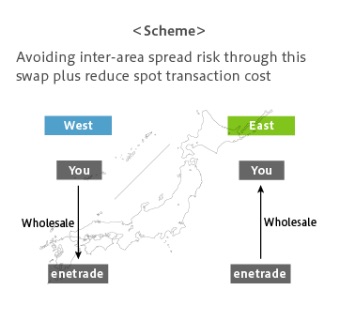

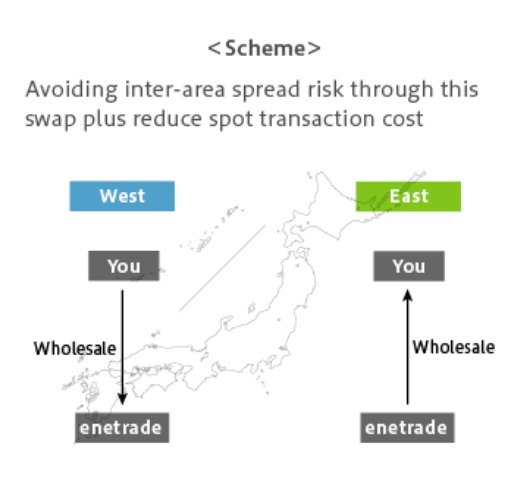

We provide flexible services in response to each client's requirement (i.e. volume, location, delivery option, etc) utilizing our strong nationwide power source network.

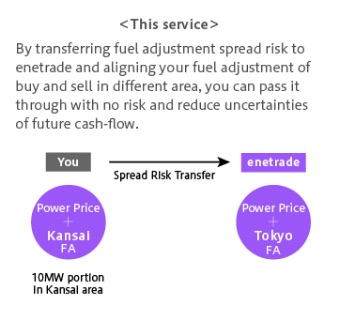

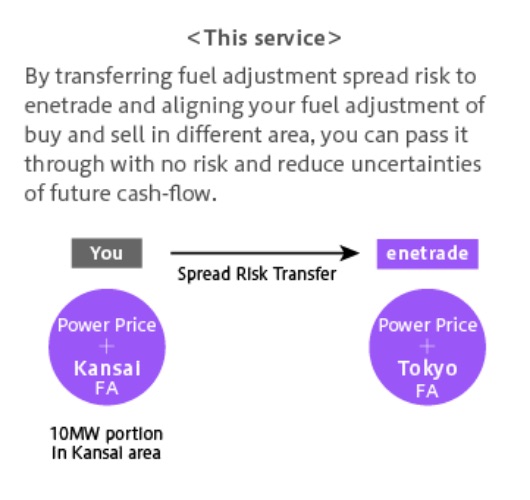

Our transactions are based on Over The Counter (OTC) contract which enables us to provide flexible tailor-made solutions according to each client's specific needs.

Our client faces only our enetrade balancing group (not each power supplier) for their transactions.

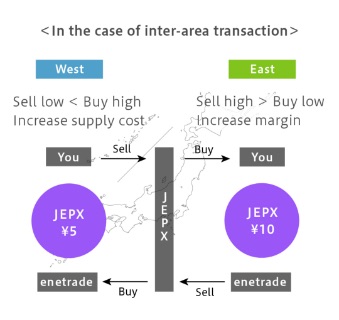

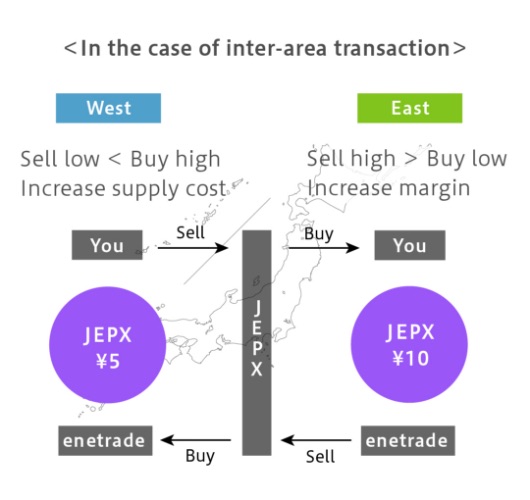

You can hedge power price risk with our tailor-made solution.

We can offer flexible payment schedule for our transactions.

We can deliver power anywhere from Hokkaido to Kyushu.

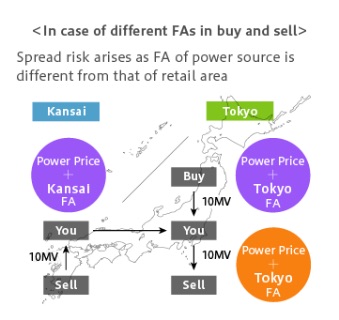

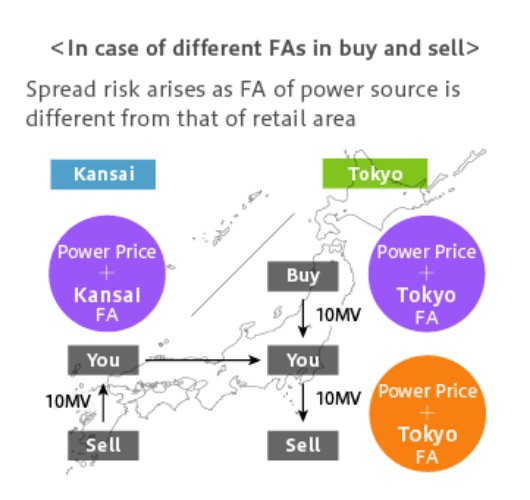

We apply innovative financial technologies to provide various solutions for price risk management